Phoenix Housing Market Update - September 2015

Phoenix Market Report September 2015

Long Term Trends

Inventory continues to shrink with the total active listings for August reporting at 17,320. This is nearly a 20% decrease in inventory from a year ago. And we are below our 5 year average of 18,515 homes for sale in August.

Sales are extremely strong as demand has improved dramtically this year. Total sales for Auguest were 6,885 which is a 10% increase from a year ago. While sales are strong they are still slightly below our 5 year average of 7,211 sales for the month of August.

Median sales price has increased 6.6% from a year ago and was $209,000 for August. This well above the 5 year average of $168,200 and shows us the radical improvement the market has made over the past 5 years.

Average days on market for August was 74. This is an improvement from a year ago when it was 86. The 5 year average is 77. This is another illustration of how much demand has improved this year.

The average sold to list price for August was 96.2%, which is up from last when it reported at 94.7%. The 5 year average is also 96.2%, so again you can see how stronger demand means homes are selling closer to list price.

Short Term Trends

In August New Listings were down from July by 5.1% and Pending Sales slightly improved by 0.4%. Closed Sales in August were 11.2% from July. This data is showing we are entering our typical seasonal slowdown as school started in August. The peak selling season generally runs from February to July, so its not surprising to see Closed Sales drop off in August, this is typical. The Median Price also dropped by 1.3% from July to August. Again, no alarms here, but something to watch. The market will probably remain fairly flat until the end of the year and then pickup again in late January. I'm not expecting a whole lot of movement in the short term on property values and inventory.

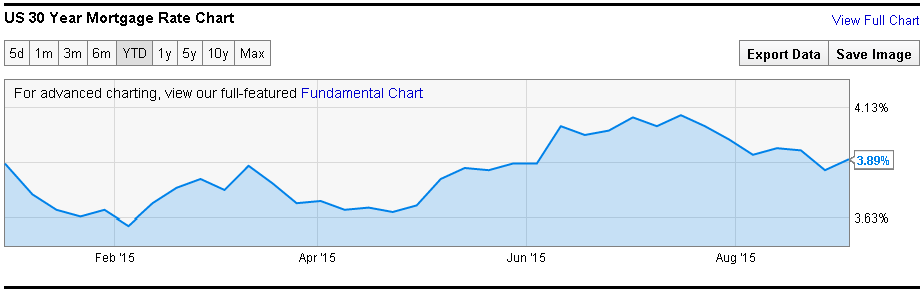

Something to watch is the impact of the recent volatility in the Stock Market and how that will affect interest rates. A slight increase in interest rates can spark a short term increase in sales as buyers jump off the fence to purchase before rates continue to rise. However if rates do continue to rise then it will have a negative impact on home values as the cost of borrowing goes up.

Download September 2015 Housing Report

Interest Rates

Interest Rate Hike 2015: 3 Things Consumers Should Do Before The Federal Reserve's Inevitable Liftoff

Clipped from the International Business Times September 9, 2015

It’s been relatively inexpensive for consumers to borrow money and pay interest on loans for the last decade. But that's about to change, possibly as soon as this month.

The U.S. Federal Reserve has kept interest rates hovering at historic, near-zero lows for nearly seven years and hasn't raised rates since 2006. With interest rate changes quickly approaching, experts are advising consumers not to panic. “This Fed rate increase will probably be a marathon, not a sprint,” said Matt Schulz, senior industry analyst at CreditCards.com.

The Fed's rate increases will be slow and gradual. The first hike, likely a quarter of a percentage point, will get a lot of attention, but it's unlikely to have a significant impact on your household budget.

“Consumers won’t even notice,” said Greg McBride, chief financial analyst at Bankrate.com. However, what will have a greater effect on consumers' wallets and purses is the culmination of a series of rate hikes over 12 to 18 months. The best course of action? In general, consumers should take steps now to reduce debt. Then households will begin to notice. The cumulative moves will have a significant effect on adjustable-rate mortgages, credit card rates and home equity lines of credit, McBride said.

The Fed's inevitable interest rate hike will affect average consumers in three key areas: mortgages, credit cards and bank loans. The central bank's action could begin as soon as next Wednesday. Here's what you can do as the window of opportunity narrows:

1. Refinance The Mortgage

Consumers with adjustable-rate mortgages (ARMs) should take action now, or have a game plan to pay down the loan before big payment increases start coming their way. The best bet is to refinance into a fixed-rate mortgage, McBride advised, which are still hovering around 4 percent.

“Those are opportunities that exist now, but may not persist once the Fed starts raising interest rates,” McBride said.

The average rate on a 30-year fixed-rate mortgage has been at record lows since the Federal Reserve took steps to revive the U.S. economy following the 2007-09 financial crisis. As the central bank prepares to move away from crisis-level rates, lenders will quickly begin to set mortgage rates based on their expectations for future inflation and interest rates. The benchmark 30-year fixed-rate mortgage edged up to 4.05 percent from 4.03 percent, according to Bankrate's Sept. 2 survey of large lenders. That’s down from 4.1 percent four weeks ago and 4.24 percent a year ago.

Consumers also could refinance into one of the other hybrid ARMs to buy another five to seven years of fixed rates, which currently hover in the low 3 percent range. The rate on the benchmark 5/1 ARM (a fixed rate for the first five years and then adjustments thereafter) rose to 3.23 percent from 3.16 percent Sept. 2.

2. Chip Away At Debt

Now is also an opportunity to chip away at variable-rate debt before interest rates begin to climb, including credit cards, student loans, auto loans and home equity lines of credit. Here’s the breakdown of what a Fed hike would cost consumers:

Let’s assume a 15 percent annual percentage rate (APR), which is the current average for new credit card offers: On a $5,000 balance, with a 15 percent APR and a $150 per month payment, interest would total $1,508.52 and it would take 44 months to pay off the balance.

If the balance and the payment remain equal, but the interest rate is increased by 0.25 percent, which is in theory what would happen if the Fed raises rates by 0.25 percent, $36 would be added to the interest total. For example, if the Fed raised rates a quarter-point, a $5,000 balance with a 15.25 percent APR and a $150 per month payment equals $1,544.74 in interest over 44 months.

Although it’s not a huge amount, where it starts to add up is if the Fed continues to raise rates over the course of the next two years. For instance, if the Fed raises rates a full percentage point over time a $5,000 balance with a 16 percent APR and $150 per month payment equals $1,656.82 in interest over 45 months.

If the APR increases from 15 percent to 16 percent, roughly $150 in extra interest is added to the balance versus the initial $36 increase.

Meanwhile, on a $25,000 loan, the effects would be minimal at first because a quarter of a percentage point translates to only a few dollars a month more. “A quarter of a percent move is pretty inconsequential,” McBride said. But over the course of 18 months or two years, in a more notable fashion, that’s when it starts to make a dent in the household budget, McBride warned.

Borrowers who took out home equity lines of credit during the housing boom should be especially mindful of when the 10-year draw period comes to an end. A draw period allows a holder of a line of credit to withdraw money for a period of 10 years. Once the draw period is over, the borrower can no longer tap into the line of credit.

Once the 10-year period is up, borrowers are no longer paying just the interest on the loan. The monthly payments increase to cover interest expense and the principal balance over the remaining term of the loan.

That produces a significant payment increase completely independent of interest rates, McBride said.

3. Snag Zero-Percent Credit Card Offers

Consumers should also try to snag zero-percent introductory rates and balance-transfer offers on credit cards -- and do it now. As the Fed moves away from zero-percent interest rates, credit card issuers act accordingly and raise their interest rates. They also will be less likely to offer zero-percent rates.

“There’s a decent chance that zero-percent offering might become a bit of an endangered species soon,” Schulz said.

Those thinking of doing a balance transfer should take action as soon as possible. If banks won’t be borrowing for free anymore, they might not let their cardholders do it either.

But if the zero percent offers stick around, banks may end up going a different route and raise fees associated with those zero-percent offers. Instead of having a 3 percent balance transfer fee associated with a card, it might be 4 percent or 5 percent. “That’s significant as well,” Schulz said.

James & Amy Lombardi Background

Ranked in the Top 1% of Agents for sales production 2012, 2013, 2014, 2015. Featured in Phoenix Magazine as one of the Best of Realtors in our market for 2015. Full time licensed agent since 2004, has sold over 700 homes and sells approx 50 homes per year. Top producing Husband & Wife real estate team.